Note: For full details on the claims process for MA PFML please see our detailed article here: https://www.waughagency.com/pfml-claims/

What is the new Massachusetts Paid Family & Medical Leave Act (PFMLA)?

What is the new Massachusetts Paid Family & Medical Leave Act (PFMLA)?

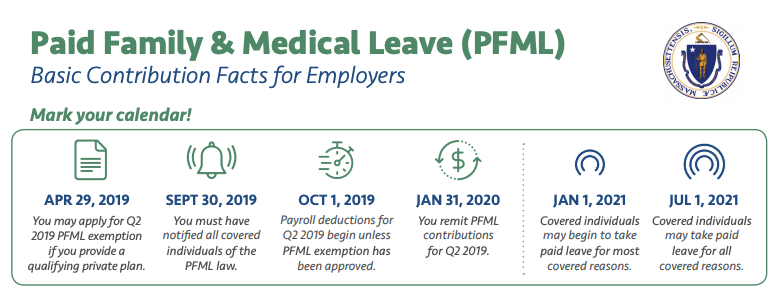

In 2018, Massachusetts signed into law the Paid Family Medical Leave Act PFMLA, a statute that provides paid family and medical leave benefits to workers. The PFMLA is funded by a payroll tax and overseen by the new Department of Family and Medical Leave. The PFML program provides temporary income replacement to eligible workers who are welcoming a new child into their family, are struck by a serious illness or injury, need to take care of an ill or ailing relative, and for certain military considerations. Final Employee notices are to be distributed by September 30th, 2019, and collection of the payroll tax is to begin on October 1, 2019 (see more details below).

What is the tax amount?

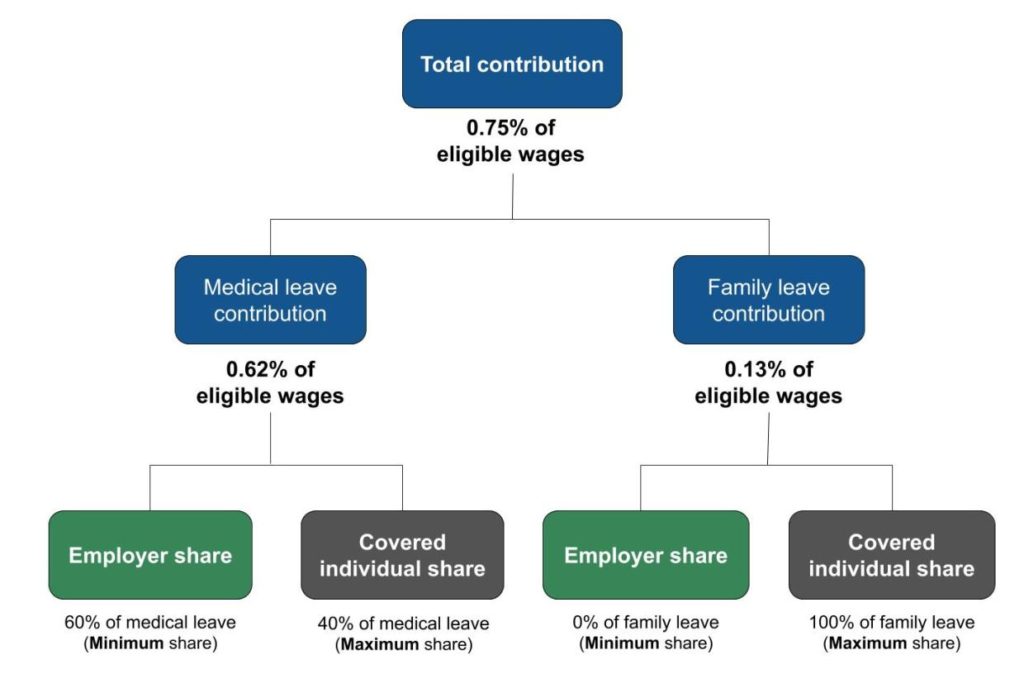

$0.75 per $100 of gross wages or other payments to all covered individuals in your workforce. This consists of 0.62% for medical leave and 0.13% for family leave.

Individual contributions are capped by the Social Security income limit, which is currently set at $132,900. The 2019 PFML income limit is calculated on wages or payments made to covered individuals from Oct. 1 – Dec. 31, 2019.

What is the employer share for each covered individual? Depends on company size…

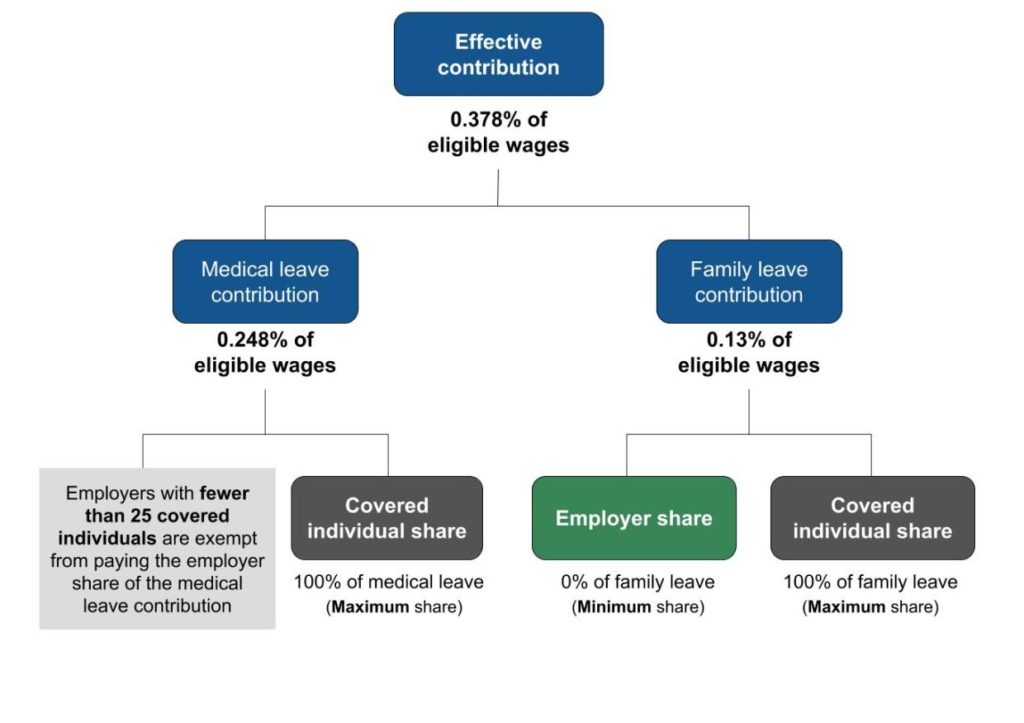

- If under 25 total employees for the majority of the year, then the employer is not responsible for any contribution, but still must collect and remit contributions beginning as of January 31, 2020, using the Department of Revenue’s MassTaxConnect system.

- For companies with 25+ employees: If your workforce included an average of 25 or more covered individuals last year, you are required to pay 60% of the medical leave contribution portion, and can deduct all of the rest from the covered individual’s wages. That is, 60% of of 0.62 per $100, or $0.372 per $100 of covered payroll. The employee is responsible for the remaining $0.248 for medical and $0.13 per $100 for family leave.

Although employers are not required to, they may elect to cover some or all of the employee share.

Who counts as a covered individual?

- All MA W-2 employees

- MA 1099-MISC contractors if they make up over 50% of your total workforce (MA employees + MA contractors)

Written notice requirements

On or before Sept. 30, 2019, Employers are required to provide written notice to their current workforce of PFML benefits, contribution rates, and other provisions as outlined in M.G.L. c. 175M sec. 4.

The notice, which may be provided electronically, must include the opportunity for an employee or self-employed individual to acknowledge receipt or decline to acknowledge receipt of the information. The employer can receive these acknowledgments in paper form or electronically. (see below for links to model notices)

Please retain these forms according to your internal document retention policy. Do not send these forms to the Department of Family and Medical Leave.

In the event that an employee or self-employed individual fails to acknowledge receipt, the Department shall consider an Employer or Covered Business entity to have fulfilled its notice obligation if it can establish that it provided to each member of its current workforce notice and the opportunity to acknowledge or decline to acknowledge receipt.

Note: The identification number assigned by the Department of Family and Medical Leave will be the employer’s Federal Employer Identification Number (FEIN). Please use your FEIN as your Employer ID Number on the written notice forms.

Coming soon- information on private plan options, and details on the claims management process (employers are to manage the claims process, ask us about support options).

Talk to us about a compliance program for your business.

Helpful Paid Family Medical Leave Act PFMLA Links:

MA PFMLA Benefit Calculator: Estimate an employee’s weekly benefit baed on quarterly earnings- https://calculator.digital.mass.gov/pfml/yourbenefits/

MA PFMLA Contribution Calculator for Employers: https://calculator.digital.mass.gov/pfml/contribution/

State of Massachusetts page with official notices for employees: https://www.mass.gov/info-details/informing-your-workforce-about-paid-family-and-medical-leave

Employer notice for a workforce with 25 or more covered individuals (DOCX 52.07 KB)

Employer notice for a workforce with fewer than 25 covered individuals (DOCX 51.93 KB)

Official State of Massachusetts FAQ Page: https://www.mass.gov/info-details/paid-family-medical-leave-for-employers-faq

Official State of Massachusetts Department of Family and Medical Leave (DFML) page: https://www.mass.gov/orgs/department-of-family-and-medical-leave

State of Massachusetts fact sheet: https://www.mass.gov/files/documents/2019/06/21/DFML_Employer_FastFacts_062119.pdf

Official State of Massachusetts PFML Rates page:

https://www.mass.gov/info-details/family-and-medical-leave-contribution-rates-for-employers

Call Waugh Agency at (800)779-4090 or email to service@waughagency.com with any questions.

The PFML effects Employers and self employed individuals. Waugh Agency will help you understand and comply with the new Massachusetts state regulations